Tissue converting is

now

part of Valmet’s o ff ering

Valmet has acquired Körber’s Business Area Tissue, a global supplier of tissue converting and packaging lines. We are happy to welcome the market leader in tissue converting and close to 1,200 dedicated new colleagues to Valmet.

Together, we offer unique benefits for tissue producers through the combination of our technologies, automation solutions and services. We also have an opportunity to develop our tissue customers’ processes further by combining data from the tissue making and converting processes.

Our experts around the world are committed to moving your performance forward – every day.

Explore our combined tissue making and converting offering www.valmet.com/tissue

SAUDI ARABIA

Crown Paper Mill expands tissue capacity

Crown Paper Mill is investing in a second Valmet’s Advantage DCT tissue line including an extensive automation package, fow control valves and Industrial Internet solutions to its mill in Saudi Arabia. The target of the investment is to meet the consumers’ increasing demand of high-quality tissue products with low environmental impact. The start-up is scheduled for the second half of 2025.

Valmet and Crown Paper Mill have a strong history of cooperation. In 2016, Crown Paper Mill purchased its frst Valmet’s tissue machine, which was installed in Abu Dhabi. The new Advantage DCT 200 is the frst tissue machine installed at their new site in Dammam area in Saudi Arabia. Valmet’s Advantage DCT 200 tissue machine is equipped with the latest technology to ensure highest product quality while reducing energy and water consumption and CO2 emissions.

“We appreciate Valmet for being an indispensable partner in Crown Paper Mill’s success. The cutting-edge technology and unwavering support have elevated our operations, making Valmet an invaluable contributor to our industry leadership. We look forward to continued collaboration and shared success,” says Abdullah Al Katheeb, Managing Director, Crown Paper Mill.

“It has been a pleasure to follow Crown Paper Mill from the start-up of the frst Valmet machine. They pay attention to all details required to produce premium tissue with high efciency, focusing on quality in all aspects. We are proud to be chosen again as their supplier and we look forward working together to make the new machine as successful as the previous one,” says Kent Nika, Sales Director South America, Tissue Mills business unit, Paper business line, Valmet.

The new tissue line will have a design speed of 2,200 m/min and a width of 5,6 meters. The production line is optimized to save energy and deliver excellent paper properties. The line will have an annual production capacity of 70,000 tons. Headquartered in the Industrial City of Abu Dhabi (ICAD), Crown Paper Mill is a leading producer of jumbo tissue paper rolls in the region. The mill has an annual production capacity of 100,000 tons of tissue for facial, toilet, kitchen, towel, napkin, C-fold and carrier grades for the United Arab Emirates.

PIF announces completion of investment in the Middle East Paper Company

The Public Investment Fund (PIF) has announced the completion of a deal to invest in the Middle East Paper Company (MEPCO), a leading manufacturer specialized in producing and recycling paper-based products in the Middle East and North Africa. PIF has acquired a 23.08% stake in MEPCO by way of a capital increase and subscription to new shares.

Through its investment, MEPCO will be able to expand its production, raise its operational efciency, and support environmental sustainability, through recyclable products –including paper goods – in line with the sustainability goals of both Saudi Arabia and PIF.

Muhammad Aldawood, Head of Industrials and Mining Sector in MENA Investments at PIF, said: “PIF’s investment in MEPCO refects the attractive opportunities for growth in promising sectors such as recycling, retail and building materials. This investment enables MEPCO to expand its sustainable production activities while focusing on high value-added products and growing its export activities.”

Eng. Sami Al Safran, CEO of MEPCO, commented: “PIF’s investment further enables the implementation of our expansion strategy and captures signifcant growth potential, both locally and regionally. This will help create new opportunities, as MEPCO continues its journey to become a national champion in our industry. Our company strives for sustainable growth and a better future, thanks to its unique strategy which integrates paper products and waste management. MEPCO is investing in the sector through ambitious projects to support Saudi Arabia’s goals of sustainability and transition to a circular economy by recycling, reducing waste and converting waste into energy sources to meet our business needs.”

About the Study

Global demand for nonwovens is forecast to increase 3.1% per year to 14 1 million metric tons in 2027 Improving standards of living will boost demand for nonwovens used in consumer and medical products, with expanding manufacturing activity further driving gains in a variety of durable goods applications

Learn About the Market

Global Demographic Changes Altering Personal Hygiene Market

Personal hygiene products are the most significant individual market for nonwovens, and infant diapers and training pants represent the largest segment of that market

Meltblown Nonwovens Producers Facing Overcapacity

Meltblown nonwovens were the product segment most severely impacted by the COVID-19 pandemic, as booming demand for medical masks led to high levels of capacity investment in this relatively low-volume segment.

Historical Market Trends

Demand for nonwovens is primarily driven by trends in manufacturing industries For most of recent history, the market size in weight terms has steadily increased with expanding economic development globally

See Also

Exclusive discount code: Save 15% with METTISSUE

About Us

Our rigorous methodology and quality control process produces industry research that is data-rich, precise, and comprehensive Our product collection covers a broad range of interrelated markets and products, which allows our analysts to cross-share findings and provide clients with greater consistency and a fuller, more contextualized viewpoint on any given topic.

Custom market research is also available. Your business is like no other. Get research like no other Better research leads to better decisions

MOROCCO UAE

Eczacibasi expands operations into Moroccan market with key acquisition

Eczacibaşı, the Turkish conglomerate renowned for its production of hygiene paper, is expanding its operations in the Moroccan market through the acquisition of Jeesr Industries SARL, a prominent player in Morocco’s hygiene sector. This strategic move comes just under a year after Eczacibaşı inaugurated its state-of-the-art manufacturing facility in Casablanca, representing a substantial investment of 25 million Euros.

The primary objective behind this acquisition is to position Eczacibaşı Consumer Products as the leading force in Morocco’s tissue paper market. By fnalizing negotiations to acquire Jeesr Industries SARL, Eczacibaşı aims to fortify the logistical and industrial infrastructure of its Moroccan subsidiary, “ECP Maroc,” solidifying its stance within the global disposable hygiene market. Pending approval from the “Moroccan Competition Council,” this acquisition will grant ECP Maroc a signifcant portion of the market share in Morocco’s rapidly expanding hygiene sector.

Eczacibaşı Consumer Products, with its globally recognized tissue paper brands such as Selpak, Solo, Silen, and Servis, has a turnover of 1.9 billion euros and a presence in over twenty countries. Jeesr Industries SARL, currently operates a tissue mill with a capacity of of 30,000 tons per year, along with converting facilities consolidated under “Riaya Industries” (Novatis). The company produces tissue paper brands Dalaa Cotonia, Sany, and Pandoo, in addition to diaper brands Dalaa and Calin.

IVORY COAST

A newcomer to the African tissue market

Nano Srl has established a new tissue mill in Abidjan, Ivory Coast. Nano Tissue will operate a Recard-supplied tissue machine, equipped with advanced crescent former technology, with a trim width of 2,750 mm, a maximum operating speed of 1,300 m/min and a production capacity of 55 tons per day.

Nano Tissue will produce a diverse range of hygienic tissue paper in jumbo rolls across various grades, ranging from 12.5 gsm to 38 gsm towels, including facial tissues, toilet paper, napkins, and kitchen towels. Nano Srl has already a decade of experience in tissue paper converting and has successfully penetrated the market in Ivory Coast and neighboring nations.

Upon full operation, the plant is expected to produce 20,000 tons per year of premium-grade paper. The inauguration of the new plant is scheduled for April 2024, marking a signifcant development in the region’s industrial landscape and potentially contributing to the local economy.

Al

Mulla Group starts-up a new packaging machine

Al Mulla Converting Industries L.LC, part of Al Mulla Group, has recently started up a new packaging line at its production base in UAE.

The Microline-supplied AL80 horizontal wrapper, is one of the most popular machines in its product portfolio, along with a shrink-wrapping tunnel and an infeed sorter. From a design perspective, the AL80 was conceived for the paper industry and AFH-type rolls, with the specifc purpose of preventing material waste during the packaging cycle while retaining the high performance the industry expects. With the specifc equipment supplied to Al Mulla, it is possible to handle single, double or triple rolls at a production rate of 70 rolls per minute for individual packs and 120 rolls per minute for double packs, based on the size and number of the products.

The machine was installed at Al Mulla Industries premises last December 2023 and immediately demonstrated performance that was in line with expectations. Microline has developed technology that combines sturdiness with fexibility and efciency. All Microline machines are designed with a modular concept, and they provide the possibility of using diferent feeding systems as well as working with diferent types of products. Microline solutions enable savings not only in terms of packaging material but also in terms of energy consumption.

Headquartered in Fujairah, UAE, Al Mulla group is a multidisciplinary conglomerate, engaged in a wide spectrum of business activities, including Trading and Contracting, Automobiles, Marine Engineering, Tissue Paper Converting, Plastic Products, Logistics and Travel & Tourism. Al Mulla Industries L.LC is one of the leading tissue paper products converting companies in the Middle East.

proven technologies long-lasting maximum performances

high speed best paper quality

flexibility

energy saving

customized and optimized design new generation software integrated end-of-line solutions

A.Celli has long-standin g, proven expertise in the construct ion of complete tissue plants Basic and detail engineering, electr cation and automat ion are performed by inter nal engineer teams to optimise the overall plant performances All activities are oriented to offer proven and granted solutions through extensive research and development activit ies that, since the foundat ion, have been of strate gic importance for the company

PORTUGAL FRANCE

The Navigator Company orders new rewinder line

Toscotec will supply an OPTIMA 1800 slitter rewinder to the Navigator Company at their Cacia production base in Aveiro, Portugal. The start-up is planned for the second half of 2024. The new OPTIMA 1800 slitter rewinder is equipped with tension and nip control for high quality winding, and it will process close to 2,800 mm width parent reels using two unwind stands. Toscotec will also supply the associated roll handling and trim removal system designed to feed the rewinder’s trim paper back to the tissue machine to maximize fber savings across the entire production line. The service package includes full onsite erection, as well as erection supervision, training, commissioning, and start-up assistance.

The Navigator Company and Toscotec have been collaborating closely since 2015, when the Navigator Company acquired tissue producer AMS who operated two high-speed Toscotec AHEAD tissue machines at their Vila Velha De Ródão mill: PM1 and PM2, started up respectively in 2009 and 2015.

Paulo Santos, Mill Manager at The Navigator Company’s Aveiro mill, says, “We are looking forward to continuing our partnership with Toscotec, who has proved in the past to be a reliable supplier for its state-of-the-art technology, fexibility, and expert services. This new rewinder line will support our growth in the international markets as a leading manufacturer of premium quality tissue.”

Gabriele Romanini, Sales Manager at Toscotec, says: “We are happy to strengthen our cooperation with The Navigator Company on this new project. Their new OPTIMA rewinder will allow them to achieve a high level of efciency while preserving paper qualities to fully capture the added value they wish to ofer to their large customer base. The new line also meets the highest safety standards with a smart concept for easy operations.”

PAPECO increases efciency with Yankee and steam plant replacement

French tissue manufacturer Papeteries du Cotentin (PAPECO), purchased a TT SYD Steel Yankee Dryer and a complete high-performance steam and condensate plant from Toscotec to fully replace their existing cast iron dryer and steam system on PM3 at their Orval sur Sienne mill in Normandy. The project includes modifcations to the machine for the new steam system and it is planned for start-up in the third quarter of 2024.

Compared with the existing cast iron Yankee, the new TT SYD will signifcantly increase PM3’s production capacity, guarantee higher operational safety, and deliver energy savings.

With more than 260 TT SYD sold globally, Toscotec holds a large majority of the market share of Steel Yankee Dryers. In the European tissue market, it has close to 95% of the market share, but it is present in more than 45 countries across 5 continents.

Emmanuel Coulon, General Manager of PAPECO, says “The installation of this TT SYD is aimed at increasing the energy efciency of our production, in line with our strong commitment to resource efciency of which the use of locally sourced recycled fbers is also a big part. The steel Yankee will increase reliability and operational safety at our mill.”

Riccardo Gennai, Toscotec Sales Manager, says, “We are happy to begin this new cooperation with PAPECO and are confdent that they will gain the competitive advantage to support their growth in the market. Our third generation design Steel Yankee delivers the highest possible drying efciency in the tissue industry, which is decisive factor for any tissue manufacturer.”

9–12 April 2024 | Messukeskus

Helsinki Expo and Convention Centre

Register for free to the event or get your conference tickets now!

Take part in the leading forum bringing together the latest forest-based bioeconomy innovations, products, services and technologies, as well as key people throughoutthe ecosystem.

The Pulp & Beyond Conference 2024 consists of three tracks: Innovative Wood-Based Products, Carbon Zero Future Mills and International Control Systems Conference 2024.

Head to pulpandbeyond.com now to explore more and secure your spot!

Conference 9 April | Exhibition 10–11 April | Excursion 11–12 April #pulpandbeyond

Explore the event & register!

See you in Helsinki, Finland in April 2024!

FINLAND

Metsä Group invests EUR 100 million in its tissue paper mill in Mänttä

Metsä Group announces its plans for a signifcant investment program in its tissue paper business in the Mänttä mill to develop the sustainability of the operations and to modernize and extend the lifecycle of the mill. The investment plans are part of its tissue paper business’ Future mill strategy program aiming at world-class efciency and environmental performance in tissue production. The planned program amounts to approximately EUR 100 million euros and the related investments are to be carried out over the period of next fve years.

The company aims to develop the mill’s production and environmental efciency by investing in paper machine and converting line modernizations as well as improving the energy and water efciency. Their aim is long term continuation of the efcient local manufacturing operations in Mänttä and they support the company’s target of all products and manufacturing sites to be fully fossil free by 2030.

“The investment program strengthens Finland’s selfsufciency in essential, locally produced hygiene products and enables modernizing our operations in Mänttä. The plans will strengthen our focus on high quality fresh fbre based hygiene products that originate from the sustainably managed Northern forests. Our Katrin, Lambi, and Serla products will deliver the benefts of the investments to the Finnish consumers”, says Joonas Kukkonen, Vice President, Supply Chain, Metsä Tissue Finland and Baltics.

As part of the planned program, the company will frst initiate an investment in a new hand towel line, which will produce fresh fbre based hand paper towels especially for the Finnish market. Preparations for the new line are being started and the line is planned to be operational during 2025.

“Locally manufactured tissue products mean local jobs and build resilience in the society. The planned investment program in Mänttä mill is a logical continuation to our on-going Future Mill investment in Mariestad, Sweden and our planned tissue paper mill investment in the UK, as well as several other investments in our international mill feet. Now we will also modernize our operations in Finland”, says Joonas Kukkonen

Metsä

Group and ANDRITZ are aiming for ambitious climate goals

Metsä Group and technology supplier ANDRITZ have agreed to work together to reduce Scope 3 greenhouse gas emissions. Scope 3 emissions refer to emissions from the company’s value chain and purchases, such as emissions during the sourcing of production equipment and raw materials and the transportation and use of manufactured products.

The goal of the multi-year cooperation is to increase the efectiveness of emission reductions and to fnd completely new ways to reduce greenhouse gas emissions. The companies have established a project group that will determine the most signifcant development targets, metrics and goals during 2024, with which the total emissions of the value chain can be reduced.

“The collaboration is a signifcant step for both companies. It shows how important part of our sustainability work is to reduce emissions from the value chain and sourcing. Together, we will fnd new ways to manage greenhouse emissions that would not necessarily be recognized if companies were operating independently,” says Jari Voutilainen, SVP Sourcing and Logistics at Metsä Group.

AUSTRIA

ANDRITZ wins 2024 Microsoft Intelligent Manufacturing Award

ANDRITZ is the winner of the 2024 Microsoft Intelligent Manufacturing Award in the category “Disrupt!”, which recognizes solutions that have the potential to fundamentally transform value chains. ANDRITZ received the award for its digital solutions enabling autonomous operation of pulp mills.

Having supported customers in further developing and optimizing their manufacturing operations for decades, ANDRITZ is now paving the way to make autonomous pulp mills a reality by leveraging its digital platform Metris.

ANDRITZ has defned a fve-level journey towards autonomy, which has been implemented across 39 pulp mills at varying levels. One of these mills has achieved 97% autonomous operation as compared to the industry benchmark of 60% to 65%. This has led to an 18% increase in productivity.

The Metris digital platform, which forms the basis for the journey towards autonomy, provides full support for industrial plants throughout their entire lifecycle, addressing customers’ main challenges such as operating costs, process stability, asset reliability, and sustainability.

SWEDEN UK

Metsä Group to install three new converting lines

Metsä Group’s tissue and greaseproof paper business is investing in three new state-of-the-art converting lines for folded and rolled tissue paper to its mill in Mariestad, Sweden. The investment will enable large scale high quality hand towel production in Scandinavia. In addition it entails efciency and energy savings as well as improved working environment and safety. The investments are part of the company´s expansion and modernisation investment in Mariestad and strategic Future Mill programme, aimed at world-class environmental and operational performance.

Metsä is investing SEK 4.2 billion (EUR 370 million) in the expansion and modernization of the Mariestad tissue paper mill, and the new converting lines are part of this extensive project. The expansion is focused on sustainable fresh fbre production, where the total share of fresh fbrebased products produced at the mill will be 80 % after the expansion is completed in the second half of 2025.

Valmet Tissue Converting S.p.A. has been commissioned to deliver two new converting lines to produce rolled tissue papers for the consumer market and C.G Bretting Manufacturing Co., Inc. to deliver one converting line for folded paper towels for professional use.

The new converting lines have a total capacity of 70,000 tons of tissue paper. “The state-of-the-art converting lines with high-efciency components ensure optimal performance and productivity. Our converting lines feature highly automated and high-quality rewinding machines, fostering a safer and more efcient working environment. Additionally, the latest folding machine opens doors for us to explore and develop new exciting products, further enhancing our capabilities”, says Esa Paavolainen, Vice President, Projects, Metsä Tissue. Metsä’s mill in Mariestad produces tissue products sold under the Serla, Lambi and Katrin brands. After the expansion, the mill will have nine converting lines.

The new tissue lines are planned to be commissioned in the second and third quarter of 2025.

WEPA Professional acquires Star Tissue UK

WEPA Professional has announced the successful acquisition of Star Tissue UK, a prominent British hygiene paper provider based in Blackburn, Lancashire. The newly acquired entity will operate under the name ‘WEPA Professional UK’, signaling WEPA’s strategic commitment to further growth in the UK’s professional hygiene market. The Blackburn plant has a converting capacity of 27,000 tons per year.

Andreas Krengel, CEO Business Unit Professional of the WEPA Group, expressed enthusiasm about the acquisition, stating, ‘WEPA stands for the production of high-quality tissue paper, and the UK market is strategically important for us. We are delighted to continue the impressive growth of Star Tissue with Managing Director Khalid Saifullah and his team as WEPA Professional UK.’

Under the leadership of Khalid Saifullah, who will remain as Managing Director, WEPA Professional UK aims to drive the integration process and foster continued growth. Khalid Saifullah stated, ‘In WEPA Professional, we have found a partner that shares our values and stands for high-quality products and frst-class customer service.’

Star Tissue has a signifcant market position with three stateof-the-art fully automated converting lines, a warehouse and modern ofce space. Thanks to the acquisition, customers will beneft from an expansion of the product portfolio and an international production network of the WEPA Group in the UK and at 12 other locations in Europe. Customers and partners can expect business as usual, with the same dedication to quality, service, and sustainability.

TAIWAN UK

ANDRITZ

to supply high-temperature Yankee hood and air system to Northwood Tissue

ANDRITZ has received a turn-key order from Northwood Tissue Ltd. to supply a new PrimeDry Hood and an air system for a tissue machine rebuild at the mill in Chesterfeld, Derbyshire, England. Start-up is planned for the third quarter of 2024.

Installation of the new ANDRITZ gas-heated PrimeDry Hood HT (High-Temperature) will increase the drying capacity thanks to an impingement temperature of up to 530°C. It will also enable a higher heat transfer rate, resulting in considerable energy optimization per ton of tissue produced.

ANDRITZ’s scope of supply includes installation work, supervision of mechanical installation, commissioning, and start-up. Guido Lenzi, Area Sales Manager at ANDRITZ Novimpianti, says, “The new drying equipment will support our customer on its path towards more sustainable and costefcient tissue production. This is the second order of that kind that Northwood Tissue has placed with us, and we are looking forward to continuing our partnership.”

David Harries, Director at Northwood Tissue adds, “This investment is another milestone in improving carbon footprint and operational efciencies. ANDRITZ is a reliable partner for projects of this kind, and I look forward to the successful completion.”

Northwood Tissue (Chesterfeld) Ltd. is a member of the Northwood Group, with over 50 years’ experience in the tissue and paper business. The group has paper making capability in excess of 100,000 tons per year in the UK and Spain, which it all processes through internal converting plants.

Yuen Foong Yu New starts up new tissue production line

Taiwanese tissue producer Yuen Foong Yu Consumer Products Co., Ltd. has successfully started up a new ANDRITZ PrimeLineCOMPACT tissue production line at its mill in Chingshui.

Mr. Tang Mingfa, Vice General Manager, Yuen Foong Yu says: “The start-up went smoothly and precisely to schedule. This new line is of utmost importance to us as it increases both the quantity and quality of our household paper production and strengthens our competitiveness on the global market. It perfectly aligns with our vision of high quality and sustainable, low-emissions production.”

The PrimeLineCOMPACT tissue machine, with a width of 3.65 m and a maximum operation speed of 1,650 m/ min, produces high quality household grades, including toilet paper, napkins, handkerchiefs, and facial tissue. It is equipped with a series of innovative components such as: PrimeFlow 2-layer headbox that minimizes slice defection to achieve best cross-profle quality, PrimePress XT Evo shoe press including Impulse shoe press sleeves to ensure top quality paper with excellent bulk and high post-press dryness, and PrimeDry Steel Yankee (18 ft. diameter) with canopy hood for energy-efcient drying and signifcant steam savings

Yuen Foong Yu is a leading supplier of household products in Taiwan with well-known brands such as “Mayfower”, “Tender” and “Delight”, and operates the largest production plant for consumer paper in Taiwan.

Conference May 13-14, 2024

Nanjing International Expo Convention Center

Exhibition May 15-17, 2024

Nanjing International Expo Center

The largest exhibition in the feld of tissue and disposable hygiene products in the world

An infuential platform for Chinese and overseas enterprises to exchange information and expand business in China

● Tissue paper & disposable products manufacturers: Tissue paper, wipes, sanitary napkins, pantyliners, baby/adult diapers, pet pads.

● Machinery manufacturers for tissue paper & disposable products: Tissue machine, cylinder, felt and wire, converting machinery, disposable hygiene products machinery, machinery for airlaid and nonwovens, other related apparatus and fttings.

● Raw/auxiliary materials suppliers: Fluf pulp, airlaid, nonwovens, flm, adhesive tape and release paper, hot melt adhesive, SAP, chemical actives, elastic band, package materials.

● Agents, distributors

Register Now

http://en.cnhpia.org/reg.html

To get the Monthly News Report of Chinese Tissue and Hygiene Products Industry

Organized by

Contact person:

Ashley (Ms. Wang Juan) Mobile: +86-15810334780

Alice (Ms. Zhang Yuan) Mobile: +86-15108406885

Tel: 86-(0)10-64778184/8197

E-mail: cidpex@cnppri.com

Http://cloud.cnhpia.org/

YouTube:

CIDPEX Instagram:

CIDPEX (China International Disposable Paper Expo)

CHINA

A.Celli started up the slitter rewinder supplied to Allmed Medical Products

The start-up of the E-WIND® SONIC supplied to the Chinese producer took place on schedule and machine performance are in line with expectations.

Allmed Medical Products Co., Ltd. signed the acceptance of the equipment following the startup of the A.Celli slitter rewinder, with satisfying results.

A.Celli scope of supply includes: E-WIND® SONIC slitter rewinder with a width of 4600 mm and design speed of 1500 mpm, an automatic shaft handling system with robot and manual positioning of pre-cut cardboard cores

The slitter rewinder has been installed downstream of a Reicofl line dedicated to the production of 12-120 gsm spunbond which already provides for an A.Celli E-WIND® WAVE master roll winder.

“Every machine delivered by A.Celli so far has overcome our expectations, and this is no exception” said Mr. Chen Fei, General Manager of Allmed Medical Products. “performance were great from the start, the service delivered by the A.Celli team is exceptional and the reliability of this solutions is topnotch. We’re very happy to be their partners”.

Headquartered in Yichang City, Allmed Medical Products is the largest Chinese OEM manufacturer and exporter of wound care products for medical and personal use.

Hengan Group successfully starts up 14th and 15th tissue machine

Guangdong Hengan Paper Co., Ltd. has successfully started up the two new ANDRITZ PrimeLine tissue machines at its mill in Yunfu, Guangdong, China. Hengan has now 15 ANDRITZ tissue machines in operation.

The two machines of the type PrimeLineCOMPACT M 1600 have a design speed of 1,700 m/min and a working width of 3.65 m. They produce top-quality tissue for facial, toilet, handkerchief, and napkin grades from virgin market pulp.

Mr. Wang Xiangyang, Vice President, Hengan Group: “Hengan and ANDRITZ have been working together for more than 25 years. We have already had 13 ANDRITZ tissue machines in operation and are convinced that the two new ones will perform just as successfully, producing high-quality tissue while enabling environmentally friendly production.”

Mr. Xie Zhengba, Chief Engineer, Guangdong Hengan Paper Co., Ltd.: “From the very beginning of this project to the start-up, we have been deeply impressed by ANDRITZ’s professional team. Each time when needed, they responded very fast and in a perfect manner. We really appreciate our partnership.”

The Hengan Group, founded in 1985, is a leading Chinese manufacturer of household paper grades as well as feminine hygiene and baby care products.

USA

Drylock expands baby diaper production capacity

Global hygiene product manufacturer, Drylock Technologies is expanding its baby care product manufacturing capacity with a new facility in Reidsville, North Carolina. Occupying a 430,000-square-foot space, the facility will feature cutting-edge technology to produce baby diapers and pants.

“People often asked me when I would be establishing a baby products plant in the USA- and I’m very happy to say that the time is now,” says CEO, Bart Van Malderen. “In 2023, we reached in excess of €1.2 billion in sales, but we’re eager to keep growing. The next step we’re taking towards further growth is to open a baby care products plant in North Carolina. With a localized manufacturing presence, we can support faster product development for our USA customers and empower them with an unparalleled speed to market.”

Drylock Technologies’ eforts and achievements towards a green future are relentless: from being the frst CO2-neutral hygiene product manufacturer to running its production on 100% green energy, continuously working to optimise product performance while minimising waste and utilising recyclable and recycled materials.

Sofdel acquires a new production plant

Sofdel has acquired from ST Paper a paper mill in Duluth, in Minnesota, in the Upper Midwest. The plant has a production capacity of 65 thousand metric tons per year and has eighty employees.

The new investment comes a few months after Sofdel made an organic growth investment to expand its integrated plant in Circleville, Ohio. The project, which has already been launched, involves the construction of a new building to house a new machine with a production capacity of 70,000 metric tons per year, which is scheduled to come into operation in the third quarter of 2025. By that time, with 200 thousand metric tons of annual capacity, Circleville will become Sofdel’s largest production site worldwide.

Tesco transforming bog-standard cardboard into luxury toilet rolls

In a supermarket frst, Tesco is rolling out a new range of toilet roll and kitchen towel made from recycled cardboard and recycled pulp. These new, 100% recycled paper products, far from being bog-standard, are soft and absorbent.

Tesco and its supplier, WEPA, have invested in innovative technology that makes it possible to turn thousands of tonnes of corrugated cardboard, in part from the rapid growth since the pandemic of home delivery services, into soft toilet roll and absorbent kitchen towel.

The recycled cardboard such as home delivery boxes and corrugated card from supermarkets is combined with other recycled paper sources, mixed with water to create a pulp and cleaned to create suitable fbres for use in paper production.

Household Category Director, Philip Banks, said: “The explosion of home deliveries since the pandemic has created an abundance of recyclable cardboard boxes right on our doorstep. The manufacturing process our supplier has developed, that turns them into incredibly soft toilet roll and kitchen towel, allows us to create a second, sustainable use for them that couldn’t be more diferent!”

The innovative pulp production process uses less water, chemicals and energy compared to using traditional tree fbre as the raw material. The paper is unbleached, giving the products their unusual beige colour.

The three new additions to Tesco’s own brand ranges of toilet roll and kitchen towel will hit shelves in 100 Tesco Extra stores across the country from the start of February with more to follow. They include: 100% recycled brown kitchen towel, luxury Soft 100% recycled brown toilet tissue 4 roll, luxury Soft 100% recycled brown toilet tissue 6 long roll. The recycled cardboard content accounts for a minimum of 70%, with the remainder of the pulp being from other recycled paper sources.

PERU BRAZIL

Suzano Papel e Celulose invests in a tissue paper making line, tissue converting equipment and a biomass boiler

Valmet will deliver a complete tissue line including a tissue making line and converting equipment to Suzano Papel e Celulose in Brazil. The order also includes a biomass boiler. This is Valmet’s frst combined order with tissue making and tissue converting lines after the acquisition of tissue converting business in late 2023. The value of the total order will not be disclosed, but such an order is typically worth around EUR 100 million.

The tissue making line, converting equipment and the biomass boiler will be installed at the Aracruz mill in Espírito Santo, Brazil. The target of the investment is to meet the Brazilian consumers’ increasing demand of high-quality tissue products with low environmental impact. The start-up is scheduled for the frst quarter of 2026.

The Advantage DCT 200 tissue machine will have an annual production capacity of 60,000 tons. The tissue making line and converting lines are optimized to save energy and deliver excellent paper properties.

“Valmet’s state-of-the-art solutions will allow us to expand our tissue products capacity by a new production line in Aracruz mill. This meets our needs in terms of business strategy, production capacity, cost efciency, and sustainability. Valmet’s proven technology, combined with the ability to deliver a 100% integrated line from tissue machine to conversion, and consistent results in its solutions were important factors in the decision for these new investments and reinforce Suzano’s vision of long-term continuity of the partnership with Valmet,” says Jean Moraes, Suzano’s Corporate Engineering Executive.

The new Valmet bubbling fuidized bed (BFB) boiler, which is scheduled to start operating in the last quarter of 2025, will use biomass to produce steam, which in turn is used in the cellulose process and in the generation of electrical energy. The new biomass boiler will increase the mill’s energy efciency, contributing to operational stability. It will also result in signifcant environmental benefts by reducing particle emissions.

Valmet will also deliver a biomass boiler that utilizes bubbling fuidized bed (BFB) technology and features very high efciency. The main fuels for the Valmet BFB boiler are bark and other wood waste from the mill. The boiler is also designed to combust non-condensable gases and methanol from the pulp mill. Flue gases are cleaned with Valmet’s electrostatic precipitator (ESP) technology.

First hybrid electric heating system for Yankee hood in tissue industry ANDRITZ was selected by tissue producer Softys Peru as technology partner for a completey new kind of hybrid Yankee hood heating system. It is the industry’s frst system that allows for a fexible combination of electric and natural gas heating. Installation and start-up of this innovative technology at Softys’s mill in Lima, was successfully completed in December 2023.

The system uses a patented air mixing plenum that allows to combine heat sources depending on the mill’s specifc needs. The customer can run the system either in 1) electric heating mode, using only the electric heater assembly, or 2) natural gas heating mode, using the burner, or 3) hybrid mode, with a freely adjustable portion of electric and natural gas heating. This provides Softys with maximum fexibility in choosing heat sources with a view to emissions reduction and energy cost optimization. The system has been installed in a tissue machine with a design speed up to 2,000 m/min and a paper width of 2.8 m. It is the result of a joint R&D project between Softys and ANDRITZ.

Reinaldo Uribe, Director of Processes and Corporate Projects at Softys, and inventor of the system, explains: “We invited ANDRITZ as a partner to develop this R&D project as part of our ESG strategy to reduce the greenhouse gas emissions from our tissue machines in Latin American, and we are happy to see that our eforts are now contributing to more sustainable mill operations. In George Nowakowski I found the perfect counterpart to implement this project – from conjoint R&D works, up to the successful patent application and start-up.”George Nowakowski, Vice President Tissue Drying America, and inventor of the system from ANDRITZ side, adds: “Collaborating with a partner like Softys gives us the great opportunity to use our mutual know-how in order to swiftly develop, extensively test and efciently implement valuable innovations that are benefcial both for the environment and operational efciency.”

Softys, part of the CMPC group, is one of South America’s largest tissue producers. The mill in Lima has an annual production capacity of approx. 100,000 tons of tissue.

GLOBAL TISSUE OUTLOOK

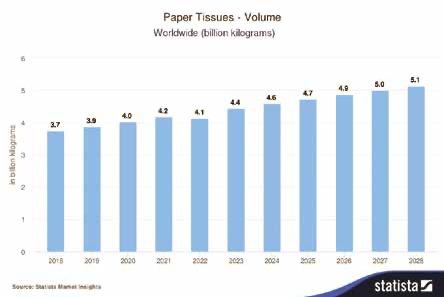

By Statista Market InsightsPAPER TISSUES

Globally, there has been a signifcant surge in the demand for paper tissues, driven by heightened awareness of hygiene and the necessity for convenient, disposable products.

• In 2024, the revenue in the Paper Tissues* market worldwide is expected to reach US$19.36bn.

• When compared globally, the United States is expected to generate the highest revenue with US$3,727m in 2024.

• It is projected that the market will experience an annual growth rate of 5.85% (CAGR 2024-2028).

• Taking into account the total population, per person revenue is anticipated to be US$2.50 in 2024.

• By 2028, the volume in the Paper Tissues market is expected to reach 5.1bn kg units.

• Furthermore, the segment is anticipated to exhibit a volume growth of 3.2% in 2025.

• Lastly, the average volume per person in the Paper Tissues market is projected to be 2.5kg units in 2024.

*The Paper Tissues market includes tissues made from pulp, facial tissues, and wet wipes.

By 2028, the volume in the Paper Tissues market is expected to reach 5.1bn kg.

The paper tissue market has experienced steady growth in recent years, fueled by an increasing demand for paper products worldwide. Factors such as growing populations, rising standards of living, and improved disposable incomes in various regions have been key drivers of this growth. However, despite these positive trends, the market faces several challenges that could potentially limit its growth.

One major challenge facing the paper tissue market is the growing competition from alternative materials like cloth and reusable products. With a rising number of consumers prioritizing environmental sustainability, many are opting for reusable cloth towels and washable napkins over disposable paper tissues. This shift in consumer behavior could lead to a decline in demand for paper products over time. Additionally, the market is also grappling with the upward trend in raw material costs, such as pulp and energy. These increased expenses may result in higher prices for paper products, potentially reducing their afordability and hindering market growth. Furthermore, the industry faces mounting pressure to mitigate its environmental impact, which could lead to stricter regulations and higher production costs for manufacturers, consequently less proftability.

Nevertheless, amidst these challenges, the paper tissue market presents several opportunities for growth. One signifcant opportunity lies in catering to the growing demand for premium, highend products. Manufacturers capable of delivering such products at competitive prices stand to beneft from increased sales and market share. Additionally, there is a rising demand for eco-friendly and sustainable paper tissue products. Consumers are increasingly seeking out items made from recycled materials or produced using environmentally friendly processes, presenting an avenue for market expansion and innovation.

Globally, the United States is expected to generate

the highest revenue with US$3,727 millions in 2024.

AMERICAS

The demand for eco-friendly paper tissues is on the rise in the Americas as consumers increasingly prioritize sustainability and environmental consciousness.

• In 2024, the Paper Tissues market in the Americas is expected to generate a revenue of US$5.43bn:

US$83.65m in Central America, US$4.40bn in North America, US$0.87bn in South America.

• It is projected to experience an annual growth rate of 2.9% (CAGR 2024-2028): 3.3% in Central America, 7.29% in North America, 5.31% in South America.

• When considering the total population, the per person revenue in the Americas is estimated to be US$5.43 in 2024: US$1.58 in Central America, US$8.62 North America, US$2.10 in South America.

• Looking ahead to 2028, the volume in the Paper Tissues market is forecasted to reach 1.1bn kg units: 29.7m kg units in Central America, 0.7bn kg units in North America, 286.7m kg units in South America.

• In 2025, the segment’s volume growth is anticipated to be 2.9%: 3.3% in Central America, 2.9% in North America, 2.9% in South America.

• Additionally, the average volume per person in the Paper Tissues market is projected to be 5.3kg units in 2024: 1.6 kg units in Central America, 8.6 kg units in North America, 2.1 kg units in South America.

AUSTRALIA AND OCEANIA

Amidst the rising concern for sustainability, Australia’s paper tissue market is witnessing a shift towards eco-friendly and recycled products.

• In 2024, the revenue in the Paper Tissues market in Australia & Oceania is expected to reach US$195.50m.

• It is projected that this market will grow annually by 4.87% (CAGR 2024-2028).

• In terms of per capita fgures, the revenue per person is estimated at US$4.50 in 2024.

• Looking ahead, the volume in the Paper Tissues market is expected to reach 59.5m kg units by 2028.

• In 2025, there is an anticipated volume growth of 2.1%.

• The average volume per person in the Paper Tissues market is expected to be 4.5 kg units in 2024.

EUROPE

The demand for paper tissues in Eastern Europe has seen a notable increase, driven by growing hygiene awareness among consumers in the region. Similarly, in Northern Europe, there is a rising demand for eco-friendly paper tissues as consumers prioritize sustainability and environmental consciousness. Moving to Southern Europe, countries like Spain and Italy stand out, where consumers have a strong preference for premium paper tissue brands due to their emphasis on quality and softness. Meanwhile, in Central & Western Europe, specifcally Germany, there’s a growing demand for eco-friendly paper tissues made from recycled materials.

• The revenue generated in the Paper Tissues market in Europe is projected to reach US$3.76bn in 2024: US$0.61bn in Easter Europe, US$203.50m in Northern Europe, US$0.93bn in Southern Europe, US$2.01bn in Central & Western Europe.

• It is forecasted that the market will experience an annual growth rate of 4.24% (CAGR 2024-2028): 4.59% in Eastern Europe, 4.64% In Northern Europe, 4.52% in Southern Europe, 4.09% in Central & Western Europe.

• In terms of per capita revenue, each person in Europe is estimated to contribute 4.24% to the Paper Tissues market in 2024: US$2.58 in Eastern Europe, US$6.01 in Northern Europe, US$3.94 in Southern Europe, US$5.99 in Central & Western Europe.

• By 2028, the volume of the Paper Tissues market is expected to reach 1.1bn kg units: 163.6m kg units in Eastern Europe, 57.0m kg units in Northern Europe, 282.4m kg units in Southern Europe, 0.6bn kg units in Central & Western Europe.

• Additionally, there will be a volume growth of 1.9% in 2025: 2.1% in Eastern Europe, 1.5% in Northern Europe, 2.4% in Southern Europe, 1.6% in Central & Western Europe.

• On average, each person in Europe is expected to consume 4.5kg units of Paper Tissues market in 2024: 2.6 kg units in Eastern Europe, 6.0kg units in Northern Europe, 3.9kg units in Southern Europe, 6.0kg units in Central & Western Europe.

ASIA

The demand for paper tissue in Asia is on the rise, fueled by increasing hygiene awareness and bolstered by rising disposable incomes in Central Asia, an expanding middle class in Southern Asia, and a growing population in Southeast Asia.

• In 2024, the revenue generated in the Toilet Paper market in Asia is expected to reach US$55.99bn: US$539.90m in Central Asia, US$13.46bn in Southern Asia, US$29.46bn in Eastern Asia, US$8.88bn in Southeast Asia, US$3.65bn in Western Asia.

• This market is projected to experience an annual growth rate of 6.55% (CAGR 2024-2028): 6.31% in Central Asia, 5.52% in Southern Asia, 7.80% in Eastern Asia, 4.82% in Southeast Asia, 4.06% in Western Asia.

• In terms of per person revenue, each individual in Asia is forecated to generate US$12.32 in the Toilet Paper market in 2024: US$6.81 in Central Asia, US$7.03 in Southern Asia, US$18.03 in Eastern Asia, US$12.82 in Southeast Asia, US$16.39 in Western Asia.

• Looking ahead to 2028, the volume of the Toilet Paper market is anticipated to reach 32.1bn kg: 410.3m kg in Central Asia, 7.8bn kg in Southern Asia, 18.0bn kg in Eastern Asia, 4.3bn kg in Southeast Asia, 1,623.0m kg in Western Asia.

• Furthermore, the segment is expected to exhibit a volume growth rate of 4.9% in 2025: 3.2% in Central Asia, 4.4% in Southern Asia, 6.0% in Eastern Asia, 2.9% in Southeast Asia, 1.5% in Western Asia.

• On an individual level, the average volume per person in Asia’s Toilet Paper market is projected to be 12.3kg units in 2024: 6.8kg units in Central Asia, 7.0kg units in Southern Asia, 18.0kg units in Eastern Asia, 12.8kg units in Southeast Asia, 16.4kg units in Western Asia.

CARIBBEAN

The demand for paper tissues in the Caribbean is rapidly increasing due to the region’s high humidity levels and the need for personal hygiene products.

• In 2024, the revenue generated in the Paper Tissues market in the Caribbean is expected to reach US$77.84m.

• It is projected that this market will experience an annual growth rate of -0.79% (CAGR 2024-2028).

• In terms of per person revenue, the Paper Tissues market will generate US$1.92 in 2024, taking into account the total population fgures.

• By 2028, the volume in the Paper Tissues market is expected to reach 17.6m kg units.

• Additionally, it is anticipated that there will be a volume growth of 2.1% in 2025.

• The average volume per person in the Paper Tissues market is expected to be 1.9 kg units in 2024.

AFRICA

The demand for paper tissues has seen a signifcant increase across Africa, driven by growing hygiene awareness and a rising middle-class population. Central Africa’s expanding middle class is fueling increased demand for premium paper tissues in the region. Similarly, Eastern Africa is experiencing a surge in demand due to heightened hygiene awareness and urbanization. Northern Africa is also witnessing a rise in demand for paper tissues, infuenced by increased hygiene awareness and changing consumer preferences. In Western Africa, demand is steadily increasing, supported by growing hygiene awareness and rising disposable incomes. However, Southern Africa still lags behind in paper tissue consumption, despite its high population and growing economy.

• In 2024, the revenue generated in the Paper Tissues market in Africa is expected to reach US$1.34bn: US$87.02m in Central Africa, US$275.20m in Eastern Africa, US$127.70m in Southern Africa, US$275.80m in Northern Africa, US$0.57bn in Western Africa.

• This market is forecasted to experience an annual growth rate of 8.83% (CAGR 2024-2028): 7.01% in Central Africa, 6.63% in Eastern Africa, 7.32% in Southern Africa, 5.91% in Northern Africa, 11.78% in Western Africa.

• Taking into account the total population, per person revenue in Africa is anticipated to reach US$1.03 in 2024: US$0.90 in in Central Africa, US$0.60 in Eastern Africa, US$1.82 in Southern Africa, US$1.06 in Northern Africa, US$1.39 in Western Africa.

• Looking ahead, the volume of the Paper Tissues market is expected to reach 0.4bn kg units by 2028: 36.4m kg in Central Africa, 112.1m kg units in Eastern Africa, 31.9m kg units in Southern Africa, 107.7m kg units in Northern Africa, 125.9m kg units in Western Africa.

• Additionally, a volume growth of 4.1% is anticipated in 2025: 4.6% in Central Africa, 5.2% in Eastern Africa, 1.3% in Southern Africa, 1.3% in Southern Africa, 3.5% in Northern Africa, 4.2% in Western Africa.

• The average volume per person in the Paper Tissues market is projected to be 1.0 kg units in 2024: 0.9 kg units in Central Africa, 0.6 kg units in Eastern Asia, 1.8kg units in Southern Africa, 1.1 kg units in Northern Africa, 1.4 kg units in Western Africa.

TOILET PAPER

• In 2024, the revenue in the Toilet Paper* market worldwide is expected to reach an impressive US$113.80bn.

• Looking ahead, the market is projected to experience an annual growth rate of 5.80% (CAGR 20242028).

• When comparing global fgures, it is notable that China is expected to generate the highest revenue, reaching US$24,300m in 2024.

• On a per person basis, the revenue generated in the Toilet Paper market is anticipated to be US$14.68 in 2024, taking into account worldwide population.

• Looking at the volume of the Toilet Paper market, it is forecasted to reach 54.7bn kg units by 2028.

• Furthermore, the segment is projected to show a volume growth of 3.5% in 2025.

• On average, each person is expected to consume 14.7kg units of toilet paper in 2024.

• Despite worldwide demand for toilet paper, developing countries like India and Nigeria face challenges in meeting the needs of their large populations.

In the coming years, the toilet paper market is expected to grow at a moderate pace, driven by rising populations and urbanization in developing countries. The increasing demand for environmentally friendly and sustainable products is expected to drive the demand for recycled toilet paper, which is a relatively untapped market. Additionally, the growing popularity of e-commerce platforms for grocery shopping is expected to increase the sales of toilet paper through online channels. Moreover, the increasing focus on hygiene and cleanliness is expected to drive the demand for high-quality toilet paper, which has a soft texture, high absorbency, and is free from harsh chemicals. This trend presents opportunities for premium toilet paper brands to gain market share from budget-oriented brands.

*The Toilet Paper market includes both wet and dry toilet paper.

INNOVATION AT WORK

CUSTOMIZED TISSUE PRODUCTS

YOUR BENEFITS

• Create your USP

• Expand your product range

• Non-contact application

• Reproducibility of the application amount

• Automatic speed compensation

• Easy operation and access

Due to the application of water based additives like softener, lotion, balm with vitamins, fragrances, natural extracts etc. you can ensure your market position easily and step into the market of high value customized products.

YOUR UNIQUE SELLING POINT WITH WEKO!

AMERICAS

In North America, the toilet paper market has seen a surge in demand due to increased hygiene awareness and panic buying during the pandemic. Similarly, in Central America, there’s been a signifcant increase in demand for toilet paper due to heightened hygiene awareness and the necessity of stockpiling essential supplies during uncertain times. Meanwhile, South America continues to exhibit a strong demand for high-quality and environmentally friendly toilet paper, despite economic challenges.

• In 2024, the Toilet Paper market in the Americas is projected to generate a revenue of US$27.52bn: US$513.90m in Central America, US$20.87bn in North America, US$5.66bn in South America.

• This market is anticipated to experience an annual growth rate of 4.72% (CAGR 2024-2028): 4.84% in Central America, 4.84% in North America, 4.66% in South America.

• In terms of per capita fgures, the revenue generated per person in the Americas is estimated to be US$27.06 in 2024: US$9.72 in Central America, US$40.89 in North America,

• Looking ahead, the volume of the Toilet Paper market is forecasted to reach 9.5bn kg units by 2028: 328.3m kg units in Central America, 5.4bn kg in North America, 3.5bn kg in South America.

• Additionally, a volume growth of 1.5% is projected for the year 2025: 2.1% in Central America, 1.2% in North America, 1.9% in South America.

• On average, individuals in the Americas are expected to consume 27.1kg units of Toilet Paper market in 2024: 9.7kg units in Central America, 40.9 kg units in North America, 13.7 kg units in South America.

AUSTRALIA AND OCEANIA

The demand for eco-friendly toilet paper made from recycled materials is rapidly increasing in Australia & Oceania.

• In 2024, the revenue in the Toilet Paper market in Australia & Oceania is expected to reach US$1.21bn.

• It is forecasted to experience an annual growth rate of 4.26% (CAGR 2024-2028).

• In terms of per person revenues in 2024, it is anticipated to be US$27.79.

• By 2028, the volume in the Toilet Paper market is expected to reach 406.5m kg units.

• Additionally, there is an anticipated volume growth of 1.8% in 2025.

• The average volume per person in the Toilet Paper market is projected to be 27.8 kg units in 2024.

EUROPE

The demand for eco-friendly toilet paper has surged in Europe, with consumers increasingly opting for biodegradable and recycled options.

• In 2024, the revenue in the Toilet Paper market in Europe is expected to reach US$20.85bn, US$3.93bn in Eastern Europe, US$1.15bn in Northern Europe, US$4.83bn in Southern Europe, US$10.94bn in Central & Western Europe.

• It is projected that the market will experience an annual growth rate of 4.35% (CAGR 2024-2028): 3.84% in Eastern Europe, 1.7% in Northern Europe, 4.23% in Southern Europe, 4.57% in Central & Western Europe.

• Considering the total population fgures, in terms of per person revenue, it is anticipated to reach US$24.70 in 2024: US$16.52 in Eastern Europe, US$33.88 in Northern Europe, US$20.41 in Southern Europe, US$32.61 in Central & Western Europe.

• Looking ahead, the volume in the Toilet Paper market is estimated to reach 8.0bn kg units by 2028: 1,881.0m kg units in Eastern Europe, 393.9m kg units in Northern Europe, 2.0bn kg units in Southern Europe, 3.8bn kg units in Central & Western Europe.

• There will be a slight volume growth of 1.5% in 2025: 1.6% in Eastern Europe, 1.7% in Northern Europe, 1.3% in Southern Europe, 1.6% in Central & Western Europe.

• The average volume per person in Europe’s Toilet Paper market is projected to be 24.7kg in 2024: 16.5kg units in Eastern Europe, US$1.15bn units in Northern Europe, 20.4kg in Southern Europe, 32.6kg units in Central & Western Europe.

CARIBBEAN

The demand for eco-friendly toilet paper in the Caribbean has been steadily increasing, refecting consumers’ prioritization of sustainability and environmental consciousness.

• In 2024, the revenue generated in the Toilet Paper market in the Caribbean is expected to reach US$479.10m.

• It is projected that this market will experience an annual growth rate of -0.80% (CAGR 2024-2028).

• In terms of per capita fgures, the revenue generated per person in 2024 is anticipated to be US$11.81.

• Looking ahead to 2028, it is expected that the volume of the Toilet Paper market will reach 214.9m kg units.

• Additionally, there is a projected volume growth of 1.4% in 2025.

• On average, each person in the Caribbean is expected to consume 11.8kg units of Toilet Paper market in 2024.

ASIA

In Japan, the demand for high-quality, eco-friendly toilet paper made from recycled materials is on the rise. Similarly, amidst growing concerns over hygiene and sanitation in Central Asia, there’s an increasing demand for high-quality toilet paper. In Southern Asia, rapid growth is observed in the demand for eco-friendly toilet paper as consumers become more conscious about sustainability. Eastern Asia also witnesses a surge in demand for eco-friendly and biodegradable toilet paper, refecting the region’s growing emphasis on sustainability. Meanwhile, in Southeast Asia, the demand for toilet paper has signifcantly surged due to increasing population and urbanization. Conversely, in Western Asia, the demand for luxurious, scented toilet paper is on the rise as consumers seek to elevate their bathroom experience.

• In 2024, the revenue generated in the Toilet Paper market in Asia is expected to reach US$55.99bn: US$539.90m in Central Asia, US$13.46bn in Southern Asia, US$29.46bn in Eastern Asia, US$8.88bn in Southeast Asia, US$3.65bn in Western Asia.

• This market is projected to experience an annual growth rate of 6.55% (CAGR 2024-2028): 6.31% in Central Asia, 5.52% in Southern Asia, 7.80% in Eastern Asia, 4.82% in Southeast Asia, 4.06% in Western Asia.

• In terms of per person revenue, each individual in Asia is forecated to generate US$12.32 in the Toilet Paper market in 2024: US$6.81 in Central Asia, US$7.03 in Southern Asia, US$18.03 in Eastern Asia, US$12.82 in Southeast Asia, US$16.39 in Western Asia.

• Looking ahead to 2028, the volume of the Toilet Paper market is anticipated to reach 32.1bn kg units: 410.3m kg units in Central Asia, 7.8bn kg in Southern Asia, 18.0bn kg units in Eastern Asia, 4.3bn kg units in Southeast Asia, 1,623.0m kg units in Western Asia.

• Furthermore, the segment is expected to exhibit a volume growth rate of 4.9% in 2025: 3.2% in Central Asia, 4.4% in Southern Asia, 6.0% in Eastern Asia, 2.9% in Southeast Asia, 1.5% in Western Asia.

• On an individual level, the average volume per person in Asia’s Toilet Paper market is projected to be 12.3 kg units in 2024: 6.8 kg units in Central Asia, 7.0 kg units in Southern Asia, 18.0 kg units in Eastern Asia, 12.8 kg units in Southeast Asia, 16.4 kg units in Western Asia.

AFRICA

The demand for toilet paper in Africa has been steadily increasing due to the growing urban population and improved hygiene practices. Particularly in Central Africa, there has been a signifcant increase in demand for toilet paper due to improved sanitation facilities and growing awareness about hygiene practices. Similarly, Eastern Africa’s toilet paper market is experiencing a surge in demand driven by increased urbanization and improving standards of living in the region. Despite the increasing popularity of bidets in many parts of the world, Southern Africa still heavily relies on traditional toilet paper for personal hygiene. In contrast, toilet paper sales in Western Africa have surged due to increased hygiene awareness and improved access to sanitation facilities.

• In 2024, the revenue in the Toilet Paper market in Africa is expected to reach US$8.20bn: US$537.20m in Central Africa, $1,689.00m in Eastern Africa, US$812.30m in Southern Africa, US$1.70bn in Northern Africa, US$3.46bn in Western Africa.

• The market is projected to grow annually by 8.08% (CAGR 2024-2028): 6.45% in Central Africa, 6.37% in Eastern Africa, 6.70% in Southern Africa, 5.17% in Northern Africa, 10.72% in Western Africa.

• In terms of per person revenue, each individual in Africa is expected to generate US$6.31 in 2024: US$5.57 in Central Africa, US$3.68 in Eastern Africa, US$11.60 in Southern Africa, US$6.53 in Northern Africa, US$8.36 in Western Africa.

• Looking ahead to 2028, it is anticipated that the volume of the Toilet Paper market in Africa will reach 4.6bn kg units: 427.2m kg units in Central Africa, 1,225.0m kg in Eastern Africa, 385.1m kg in Southern Africa, 1,232.0m kg units in Northern Africa, 1,373.0m kg units in Western Africa.

• There is an anticipated volume growth of 3.1% in 2025: 3.8% in Central Africa, 4.4% in Eastern Africa, 0.1% in Southern Africa, 2.6%. in Northern Africa, 3.1% in Western Africa.

• The average volume per person in the Toilet Paper market is forecasted to be 6.3 kg units in 2024: 5.6 kg units in Central Africa, 3.7 kg units in Eastern Africa, 11.6 kg units in Southern Africa, 6.5 kg units in Northern Africa, 8.4 kg units in Western Africa.

HOUSEHOLD PAPER

The global demand for household paper products is steadily rising, with countries like China and the United States leading the market.

• In 2024, the revenue in the Household Paper market* worldwide is expected to reach a staggering US$90.14bn.

• This market is projected to experience an annual growth rate of 4.60% (CAGR 2024-2028).

• When compared globally, the highest revenue is generated in China, reaching US$17,050m in 2024.

• Taking into account the total population fgures, the per person revenue in 2024 is anticipated to be US$11.63.

• Looking ahead, by 2028, the volume in the Household Paper market is forecasted to reach 28.3bn kg units.

• Additionally, the segment is projected to demonstrate a volume growth of 2.3% in 2025.

• On average, each person is expected to consume 11.6kg units of Household Paper market in 2024.

The household paper market is shifting towards premium oferings as consumers increasingly prioritize high-quality, eco-friendly options due to mounting environmental concerns and a heightened preference for sustainability. Companies can capitalize on this trend by investing in eco-friendly alternatives, including products made from recycled materials and those manufactured using environmentally conscious processes. Another lucrative opportunity lies in innovating products to meet evolving consumer preferences, such as kitchen rolls with dispensers or more durable and absorbent table napkins. The growing emphasis on comfort and convenience is expected to drive demand for premium household paper products, positioning the market for steady growth fueled by the rising interest in convenient, hygienic, and sustainable solutions, as well as the expanding presence of e-commerce platforms.

*The Household Paper market covers all kinds of tissue paper which are used for household care, including paper towels, table napkins, kitchen rolls, and tablecloths.

AMERICAS

In the Americas, there is a rapid increase in demand for eco-friendly household paper products, fueled by growing consumer awareness of environmental sustainability and supported by government initiatives promoting sustainability. Additionally, the South American market holds signifcant importance in the Household Paper market, contributing signifcantly to its overall revenue and volume growth.

• In 2024, the revenue in the Household Paper market in Americas is expected to reach US$19.06bn: US$0.45bn in Central America, US$13.37bn in North America, US$4.83bn in South America.

• It is projected that the market will experience an annual growth rate of 4.18% (CAGR 2024-2028): 5.14% in Central America, 4.20% in North America, 4.36% in South America.

• Taking into account the total population fgures, in 2024, each person in Americas is expected to generate US$18.74 in revenue in the Household Paper market: US$8.59 in Central America, US$26.20 in North America, US$11.68 in South America,

• By 2028, the volume in the Household Paper market is forecated to reach 5.8bn kg units: 184.4m kg units in Central America, 3.5bn kg units in North America, 1.9bn kg units in South America,

• Furthermore, a volume growth of 1.3% is anticipated in 2025: 2.2% in Central America, 1.0% in North America, 1.9% in South America,

• The average volume per person in the Household Paper market is projected to be 18.7 kg units in 2024 in Americas: 8.6 kg units in Central America, 26.2 kg units in North America, 11.7 kg units in South America.

AUSTRALIA AND OCEANIA

The demand for eco-friendly household paper products is on the rise in Australia, driven by increased awareness of sustainability and environmental concerns.

• In 2024, the revenue in the Household Paper market in Australia & Oceania is expected to reach US$0.85bn.

• It is projected that the market will experience an annual growth rate of 4.15% (CAGR 2024-2028).

• In terms of per capita fgures, the revenue generated per person is projected to be US$19.59 in 2024.

• By 2028, the volume in the Household Paper market is forecasted to reach 233.4m kg units.

• Additionally, a volume growth of 1.3% is anticipated in 2025.

• On average, each person in Australia & Oceania is expected to consume 19.6 kg units of Household Paper market in 2024.

EUROPE

The European household paper market is witnessing a notable rise in demand for eco-friendly and sustainable products, driven by heightened environmental consciousness. Leading this trend is Germany, which ofers a diverse array of such products.

• In 2024, the revenue generated in the Household Paper market in Europe is expected to reach US$16.60bn: US$3.24bn in Eastern Europe, US$0.81bn in Northern Europe, US$4.27bn in Southern Europe, US$8.28bn in Central & Western Europe,

• It is projected that the market will experience an annual growth rate of 3.61% (CAGR 2024-2028): 3.30% in Eastern Europe, 3.51% in Northern Europe, 3.92% in Southern Europe, 3.55% in Central & Western Europe.

• Taking into account the total population fgures, per person revenue in Europe is anticipated to be US$19.67 in 2024: US$13.61 in Eastern Europe, US$23.88 in Northern Europe, US$18.05 in Southern Europe, US$24.69 in Central & Western Europe.

• By 2028, the volume of the Household Paper market is forecated to reach 4.1bn kg units: 1.0bn kg units in Eastern Europe, 194.6m kg units in Northern Europe, 1.1bn kg units in Southern Europe, 1.8bn kg units in Central & Western Europe.

• There will be a slight volume growth of 0.6% in 2025: 1.1% in Eastern Europe, 0.8% in Northern Europe, 0.7% in Southern Europe, 0.3% in Central & Western Europe.

• On average, each person is expected to consume 19.7kg units of household paper in Europe in 2024: 13.6 kg units in Eastern Europe, 23.9 kg units in Northern Europe, 18.1 kg units in Southern Europe, 24.7 kg units in Central & Western Europe.

CARIBBEAN

The demand for household paper products in the Caribbean is increasing due to the rising disposable income and growing tourism industry.

• In the Caribbean, the revenue generated in the Household Paper market is projected to reach US$0.41bn in 2024.

• This market is expected to experience an annual growth rate of -0.62% (CAGR 2024-2028).

• In relation to the total population, the per person revenue is anticipated to be US$10.01 in 2024.

• Looking ahead, the volume in the Household Paper market is forecasted to reach 119.0m kg units by 2028.

• Moreover, there is a projected volume growth of 1.3% expected in 2025.

• In terms of average volume per person, it is expected to amount to 10.0 kg units in 2024 in the Household Paper market.

ASIA

In Japan, there’s a notable surge in demand for eco-friendly and sustainable household paper products. Central Asia is witnessing a rise in demand for premium-quality items, infuenced by growing disposable income and evolving consumer preferences. Southern Asia, particularly in countries like India and Bangladesh, is experiencing a rapid growth in demand for eco-friendly options, refecting strong consumer preferences for sustainability. Moreover, in Eastern, Western, and Southeast Asia, the demand for environmentally friendly household paper products is steadily increasing, propelled by a growing awareness of environmental issues among consumers.

• The revenue in the Household Paper market in Asia is projected to reach US$46.40bn in 2024: US$0.48bn in Central Asia, US$13.63bn in Southern Asia, US$21.66bn in Eastern Asia, US$7.54bn in Southeast Asia, US$3.09bn in Western Asia.

• This market is expected to experience an annual growth rate of 4.59% (CAGR 2024-2028): 6.17% in Central Asia, 4.19% in Southern Asia, 4.94% in Eastern Asia, 4.58% in Southeast Asia, 2.6% in Southeast Asia, 3.60% in Western Asia.

• In terms of per person revenues, the Household Paper market in Asia is estimated to generate US$10.21 per individual in 2024: US$6.00 in Central Asia, US$7.11 in Southern Asia, US$13.25 in Eastern Asia, US$10.89 in Southeast Asia, US$13.88 in Western Asia.

• Looking ahead, the volume in the Household Paper market is anticipated to reach 15.6bn kg by 2028: 229.4m kg units in Central Asia, 4.6bn kg units in Southern Asia, 7.5bn kg units in Eastern Asia, 2.4bn kg units in Southeast Asia, 0.9bn kg units in Western Asia.

• Additionally, the segment is expected to exhibit a volume growth of 3.0% in 2025: 3.2% in Central Asia, 3.0% in Southern Asia, 3.3% in Eastern Asia, 2.6% in Southeast Asia, 1.3% in Western Asia.

• On average, each person in Asia is projected to consume 10.2kg units of Household Paper market in 2024: 6.0kg units in Central Asia, 7.1kg units in Southern Asia, 13.2kg units in Eastern Asia, 10.9kg units in Southeast Asia, 13.9kg units in Western Asia.

AFRICA

The demand for household paper products in South Africa is experiencing steady growth, attributed to the expanding middle-class population and shifting consumer preferences. Similarly, in Central and Southern Africa, increasing urbanization and improving living standards are driving up the demand for household paper products. Eastern Africa has seen a consistent rise in the demand for eco-friendly options, particularly in countries like Kenya and Tanzania, where consumers strongly favor sustainable choices. Northern Africa is also witnessing a steady increase in demand, propelled by population growth and rising disposable incomes. Furthermore, Western Africa is experiencing a similar trend, with a growing middle class and urbanization contributing to the rising demand for household paper products.

• In 2024, the revenue in the Household Paper market in Africa is expected to reach US$7.24bn: US$0.47bn in Central Africa, US$1.47bn in Eastern Africa, US$0.71bn in Southern Africa, US$1.50bn in Northern Africa, US$3.07bn in Western Africa.

• It is projected that the market will experience an annual growth rate of 7.95% from 2024 to 2028 (CAGR 20242028): 6.30% in Central Africa, 5.92% in Eastern Africa, 6.40% in Southern Africa, 5.10% in Northern Africa, 10.82% in Western Africa.

• In terms of per capita income, the revenue generated per person in Africa’s Household Paper market is anticipated to be US$5.57 in 2024: US$4.92 in Central Africa, US$3.21 in Eastern Africa, US$10.20 in Southern Africa, US$5.76 in Northern Africa, US$7.42 in Western Africa.

• Looking ahead to 2028, the volume in the Household Paper market is forecasted to reach 2.6bn kg units: 237.2m kg units in Central Africa, 0.7bn kg units in Eastern Africa, 217.1m kg units in Southern Africa, 0.7bn kg units in Northern Africa, 0.8bn kg units in Western Africa.

• Furthermore, a volume growth of 3.0% units is projected for 2025: 3.8% in Central Africa, 4.1% in Eastern Africa, 0.3% in Southern Africa, 2.5% in Northern Africa, 3.1% in Western Africa.

• On average, each person in Africa is expected to consume 5.6kg units of Household Paper market in 2024: 4.9kg units in Central Africa, 3.2kg in Eastern Africa, 10.2kg units in Southern Africa, 5.8kg units in Northern Africa, 7.4kg units in Western Africa.

THE FUTURE OF TISSUE IS HERE

Discover your future with the most comprehensive machinery and services for converting, packaging, end-of-line automation and folding equipment.

BOOTH H03

16-18 April

Paper & Tissue One Show

Abu Dhabi National Exhibition Center

TISSUE PRODUCERS IN THE MIDDLE EAST AND NORTH AFRICA

NONWOVEN &

TEXTILE

RECYCLE YOUR DIAPERS WASTE TO VALUE

SEPARATION AND RECYCLING PROCESS FOR ABSORBENT HYGIENE PRODUCTS (AHP)

RECYCLING WASTE IS CRUCIAL FOR ENVIRONMENTAL SUSTAINABILITY

Recycling industrial AHP waste is a complex but crucial process to reduce environmental impact.

Industrial AHP waste consists of

layers of absorbent materials, plastics, and adhesives. These components require special techniques for separation and recycling. ANDRITZ has developed a comprehensive process to recycle SAP, fluff pulp, and other components of

AHP, while maintaining high material quality. This recycling process is the result of a joint effort within ANDRITZ Nonwoven & Textile and contributes to the development of more sustainable practices for the disposal and recycling of industrial AHP waste.

Market value is expected to rise 3.4% per year to $63.1 billion in 2027, a deceleration from the prior fve-year period as price growth moderates following above-average increases from 2020 to 2022 that resulted from:

• supply chain disruptions associated with the pandemic, as producers faced unreliable logistics and inconsistent raw materials supply.

• surging demand for certain nonwoven-inclusive products, most notably medical masks.

• a spike in the prices of oil and petroleum products following the 2022 onset of the Russia-Ukraine war.

GLOBAL NONWOVENS OUTLOOK

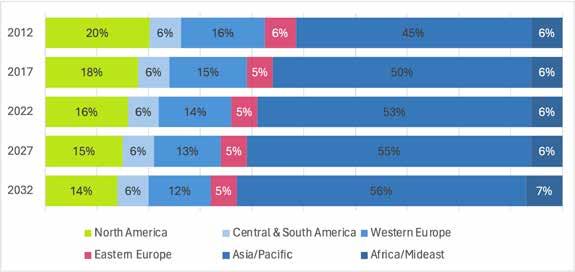

Global demand for nonwovens is forecast to increase 3.1% per year to 14.1 million metric tons in 2027. Improving standards of living will boost demand for nonwovens used in consumer and medical products, with expanding manufacturing activity further driving gains in a variety of durable goods applications.

Elliott Woo, Global Industry Analyst, Freedonia GroupAsia/Pacifc is expected to post the largest gains, rising to half of the world market in 2027. The region represents a somewhat smaller share of the total by value than by weight, refecting relatively low-price levels in many lower-income countries. Growth will be driven by expansion in the region’s lower-income countries:

• Improving standards of living will boost demand for and production of wipes and personal hygiene products.

• Development of regional manufacturing industries will support sales in applications like fltration, motor vehicles, and electrical and electronic equipment.

North America and Western Europe will continue to be important outlets for higher-end nonwovens and contribute to large markets for these products (in value terms). However, growth will be restrained by market maturity in both regions. Eastern Europe holds stronger growth prospects, as demand will be boosted by expansion of manufacturing industries throughout the region.

Africa/Mideast and Central and South America will remain among the world’s smallest regional markets for nonwovens in 2027. Both regions have underdeveloped manufacturing sectors, with limited fnancial fexibility reducing average price levels and further restraining the market size by value.

Personal hygiene market outlook

The personal hygiene market includes:

• infant diapers and training pants

• feminine hygiene products

• adult incontinence products

Nonwovens typically make up large portions of these products due to their use as absorbent core materials, cover stock, and backings. Personal hygiene products used in medical settings (e.g., patient care incontinence products) are included in this category.

Demand for personal hygiene end-use products is infuenced by population changes in certain demographics:

• infants and toddlers (diapers and training pants)

• women aged 15-49 (feminine hygiene products)

• people aged 65 and over (adult incontinence products)